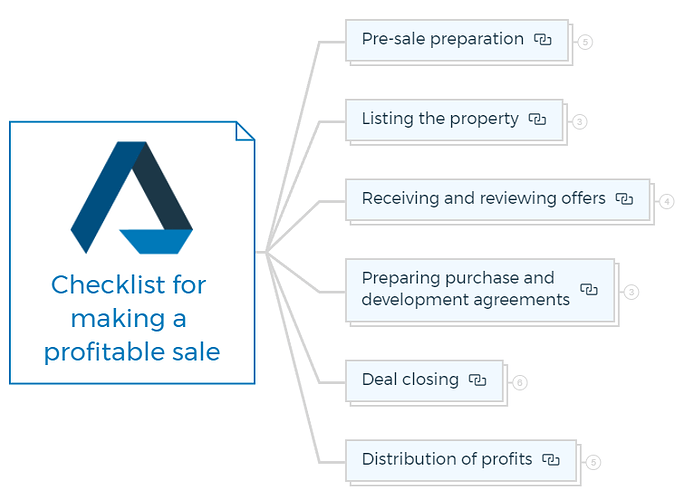

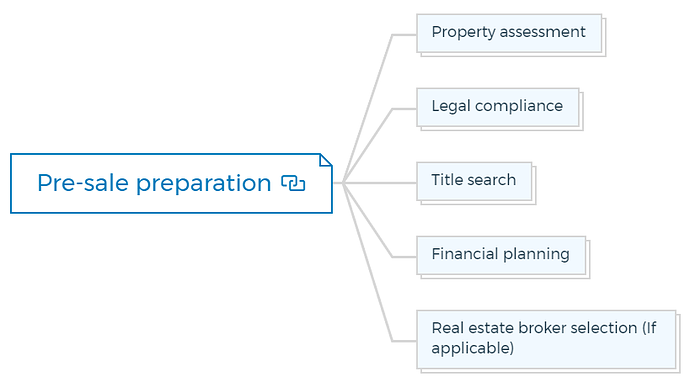

1. Pre-sale preparation

1.1. Property assessment

- Determine the property’s current market value.

- Identify any necessary repairs or improvements to maximize value.

1.2. Legal compliance

- Ensure the property complies with all local zoning and building codes.

1.3. Title search

- Verify clear title and resolve any outstanding issues.

1.4. Financial planning

- Calculate your expected profits and set a minimum acceptable price.

1.5. Real estate broker selection (If applicable)

- Decide whether to hire a real estate broker based on your goals and budget.

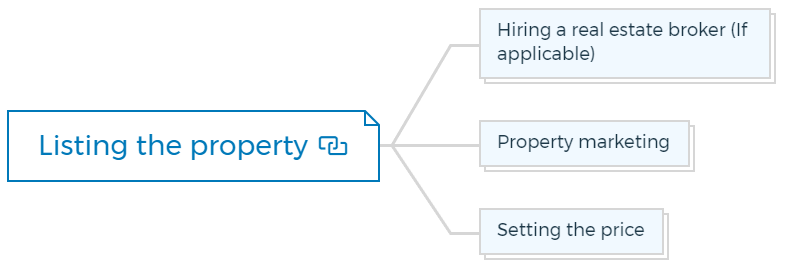

2. Listing the property

2.1. Hiring a real estate broker (If applicable)

- Choose a qualified and reputable real estate broker.

2.2. Property marketing

- Create a compelling property listing with high-quality photos.

- Utilize online platforms, social media, and traditional marketing methods.

2.3. Setting the price

- Set an attractive but competitive listing price.

You are missing out if you haven’t yet subscribed to our YouTube channel.

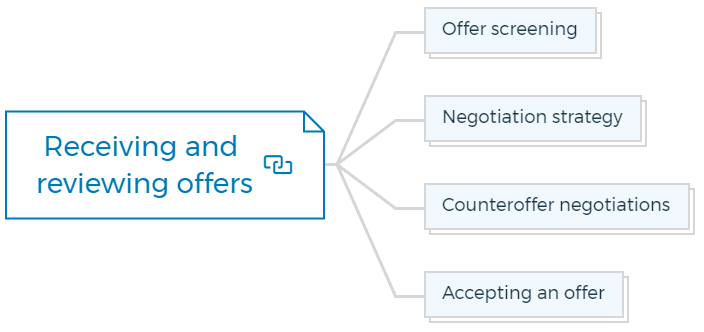

3. Receiving and reviewing offers

3.1. Offer screening

- Carefully review and assess offers from potential purchasers.

3.2. Negotiation strategy

- Determine your negotiation approach, including counteroffer thresholds.

3.3. Counteroffer negotiations

- Engage in negotiation with potential buyers to reach favorable terms.

3.4. Accepting an offer:

- Once you accept an offer, the purchaser usually pays a deposit.

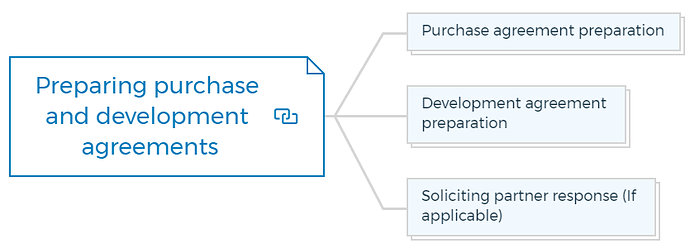

4. Preparing purchase and development agreements

4.1. Purchase agreement preparation

- Draft or review the purchase agreement, including key terms and conditions.

4.2. Development agreement preparation

(If selling prior to construction completion)

- Prepare a development agreement outlining responsibilities and timelines.

4.3. Soliciting partner response (If applicable)

If you have partners, seek their approval on the proposed sale.

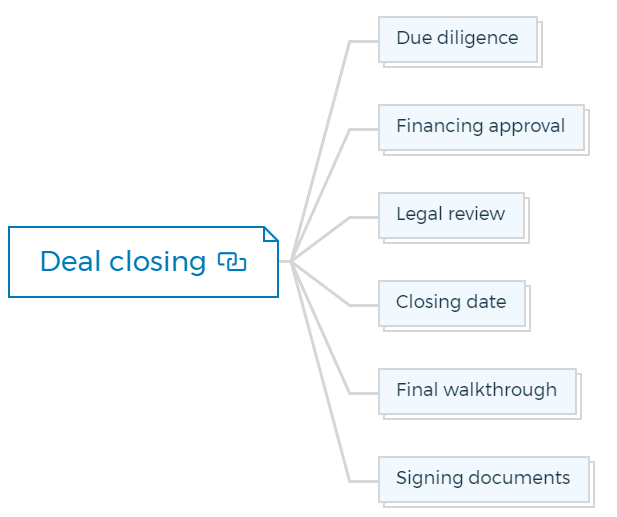

5. Deal closing

5.1. Due diligence

- Facilitate inspections, appraisals, and any necessary surveys.

Learn More

5.2. Financing approval

- Ensure the buyer’s financing is approved.

5.3. Legal review

- Have legal professionals review all documents for accuracy and compliance.

5.4. Closing date

- Schedule the closing date and location.

5.5. Final walkthrough

- Conduct a final walkthrough with the buyer to ensure the property’s condition.

5.6. Signing documents:

- Sign all necessary documents, including the deed and transfer documents.

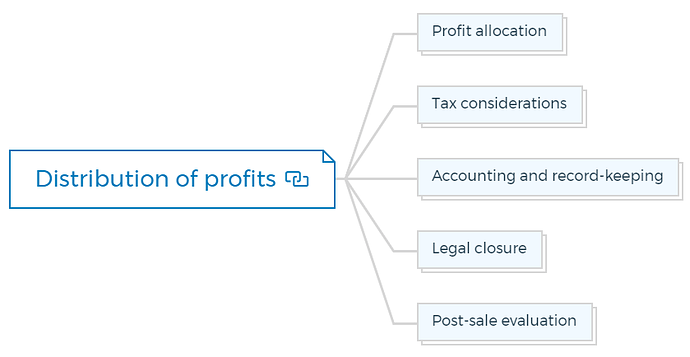

6. Distribution of profits

6.1. Profit allocation

- Distribute the sale proceeds to all relevant parties, including partners and lenders.

6.2. Tax considerations

- Consult with a tax professional to understand tax implications and plan accordingly.

6.3. Accounting and record-keeping

- Maintain detailed records of the sale for tax purposes.

6.4. Legal closure

- Close out all legal and financial obligations related to the property sale.

6.5. Post-sale evaluation

- Evaluate the overall success of the sale and identify areas for improvement.