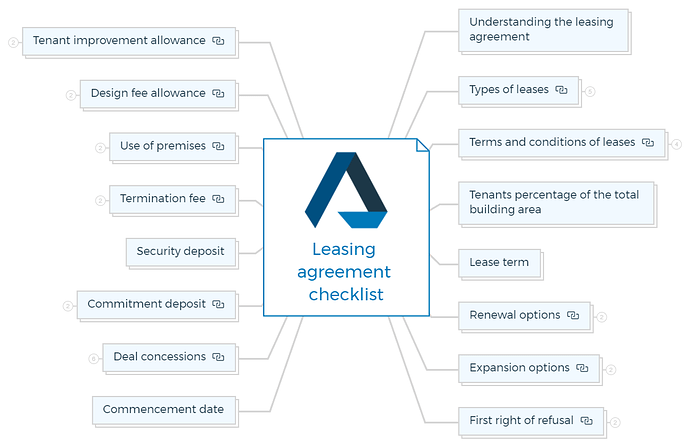

1. Understanding the leasing agreement

- Recognize that a leasing agreement is a legally binding contract between the lessor (owner) and lessee (tenant) outlining terms and conditions for occupying a rental space.

- Stress the importance of professional preparation and comprehensive review to ensure accuracy and fairness.

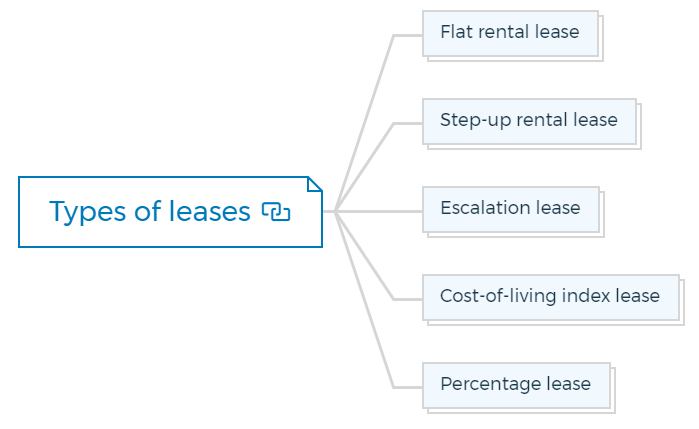

2. Types of leases

- Clarify various lease types:

2.1. Flat rental lease

Tenant pays a predetermined fixed monthly rent, offering clarity but exposing the lessor to expense increases.

2.2. Step-up rental lease

Rental rates increase at predetermined future dates, providing flexibility for both parties.

2.3. Escalation lease

Rental payment increases based on factors such as operating expenses, taxes, or services.

2.4. Cost-of-living index lease

Yearly rent increases tied to a predetermined cost-of-living index range.

2.5. Percentage lease

Retail leases tied to a percentage of tenant’s gross income over a specified threshold, allowing lessor to share tenant success.

- Emphasize the need for careful evaluation of each type’s implications on both lessor and lessee.

You are missing out if you haven’t yet subscribed to our YouTube channel.

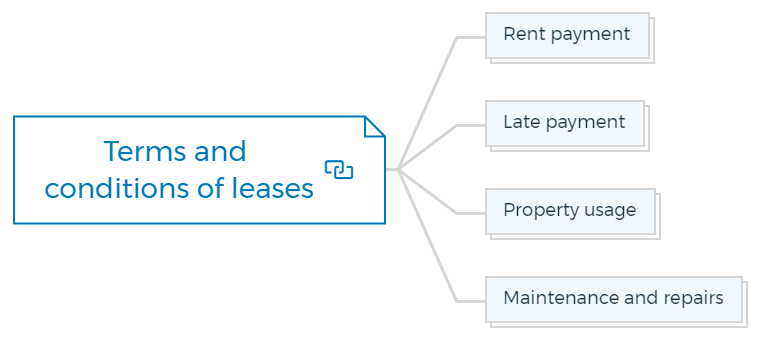

3. Terms and conditions of leases

- Define essential terms and conditions:

3.1. Rent payment

Specify rent amount, frequency, and acceptable payment methods.

3.2. Late payment

Outline penalties or fees for late rent payments.

3.3. Property usage

Clearly define permitted use of the premises, including any restrictions.

3.4. Maintenance and repairs

Allocate responsibilities for property maintenance and repairs between lessor and lessee.

4. Tenants percentage of the total building area

- Include total building area and individual tenant’s square footage.

- Critical for equitable distribution of operating expenses among tenants based on their occupied space.

5. Lease term

- Specify lease duration with distinct start and end dates.

- Acknowledge the importance of differentiating between lease terms and any early possession arrangements.

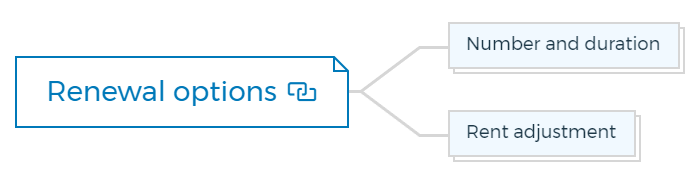

6. Renewal options

- Define terms for lease renewal:

6.1. Number and duration

Specify the number and length of potential renewal periods.

6.2. Rent adjustment

Clarify if and how rent might change upon renewal.

Learn More

7. Expansion options

- Address future space expansion options for tenants:

7.1. Available space

Detail potential expansion areas, size, and location.

7.2. Cost and timing

Clarify costs associated with expansion and deadlines for exercising options.

8. First right of refusal

- Explain the concept of the first right of refusal:

8.1. Predetermined space

Specify spaces subject to this right.

8.2. Decision window

Define the time frame within which the tenant must decide to exercise the right.

9. Commencement date

- Clearly state the official commencement date of the lease term.

- Clarify any distinction from early occupancy arrangements.

10. Deal concessions

Elaborate on potential concessions offered to tenants

10.1. Free rent

Explain periods of waived or reduced rent payments.

10.2. Additional parking

Specify extra parking spaces included in the deal.

10.3. Tenant improvement allowance increase

Detail possible enhancements to the standard tenant improvement allowance.

10.4. Up-front cash payment

Clarify any initial cash payment from the developer to the tenant.

10.5. Moving expenses

Explain potential coverage of moving-related costs by the developer.

10.6. Free memberships

Describe offers of complimentary local business or health club memberships.

11. Commitment deposit

11.1. Deposit function

Explain how the deposit contributes to defraying expenses or securing commitment.

11.2. Refund or application

Clarify whether the deposit is refundable or applied to subsequent payments.

12. Security deposit

12.1. Rental security

Emphasize the deposit’s role in covering potential damages or unpaid rent.

12.2. Refund or application

Specify whether the deposit is refundable or applied to the final month’s rent.

13. Termination fee

Clarify scenarios and procedures related to early lease termination:

13.1. Early exit

Describe conditions under which the tenant can terminate the lease early.

13.2. Fee or compensation

Detail potential fees or compensatory arrangements in case of early termination.

14. Use of premises

Detail permissible use of the leased space

14.1. Approved activities

Clearly outline activities allowed within the premises.

14.2. Prohibited activities

Specify any activities that are prohibited within the leased space.

15. Design fee allowance

15.1. Tenant space planning

Define the allowance for planning and designing the tenant’s interior space.

15.2. Allocation and scope

Specify the amount and potential usage of the allowance.

16. Tenant improvement allowance

16.1. Specified allowance

Describe the predetermined allowance for making improvements to the leased space.

16.2. Exceeding allowance

Explain options for handling costs exceeding the initial allowance.