Summary

Explanation of Permanent Loan Takeout:

Explanation of Permanent Loan Takeout:

- A permanent loan takeout pays off a construction loan after project completion, including the capitalized interest accumulated during construction.

- The total loan amount is based on project costs plus interest.

Stabilized Financial Metrics:

Stabilized Financial Metrics:

- Key values such as stabilized Net Operating Income (NOI), cap rate, and total construction debt impact the permanent loan’s calculation.

- The reporting system shows projections and alerts when sections lack input values.

Construction Loan Details:

Construction Loan Details:

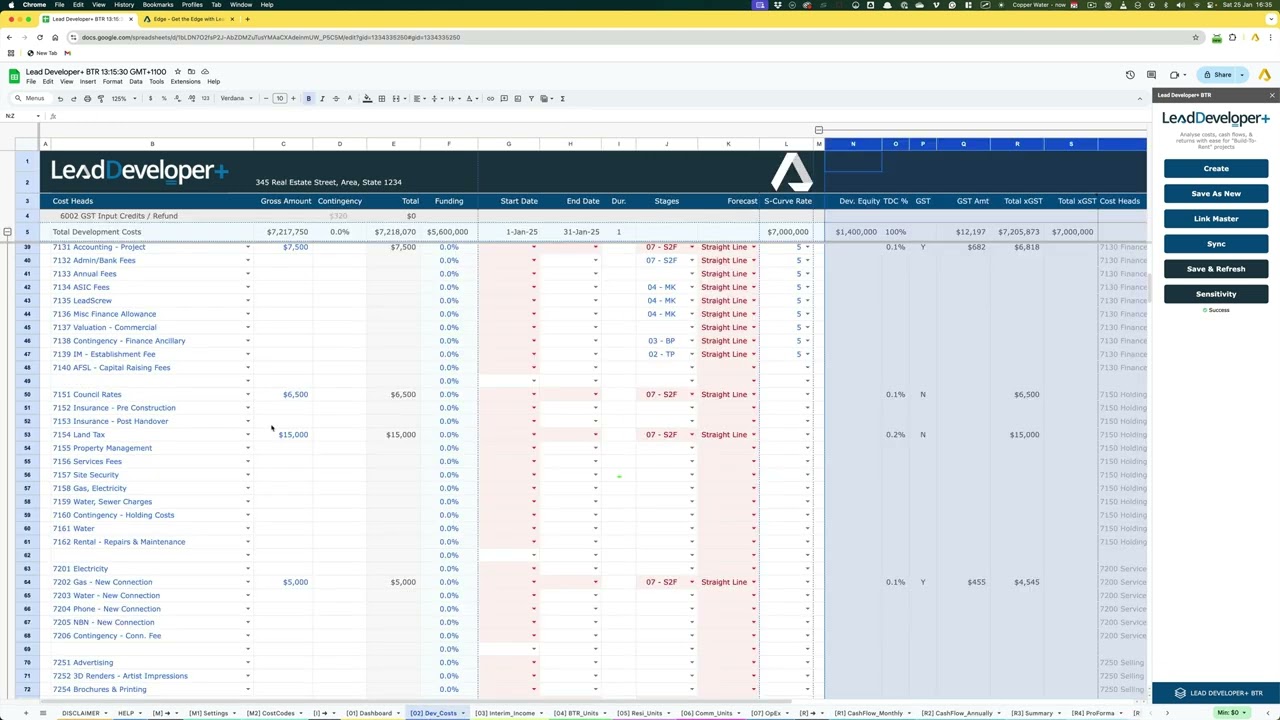

- Construction costs, unit details (residential, commercial), and cash flow timelines need accurate input to calculate totals effectively.

- Land acquisition is often the first value entered, with other costs added progressively.

Loan Dynamics:

Loan Dynamics:

- Details about how interest rates (fixed or variable) and gaps in input cells default to annual rates to ensure consistent calculations.

- Exit fees are calculated only when applicable to a remaining loan balance.

Interest Only Periods:

Interest Only Periods:

- An 84-month timeline was discussed with two initial years being interest-only; principal payments begin thereafter.

- Loan payoff calculations depend on these timelines and structures.

Conclusion:

Conclusion:

- All calculations hinge on accurate and complete input values; without them, the system defaults to placeholders or remains inactive.

Insights Based on Numbers

- $7 Million Land Acquisition:

- Represents the starting point of project financing before adding construction costs.

- 84-Month Loan Timeline:

- Signifies the structured payoff period, impacting both lender and borrower yields.