Summary

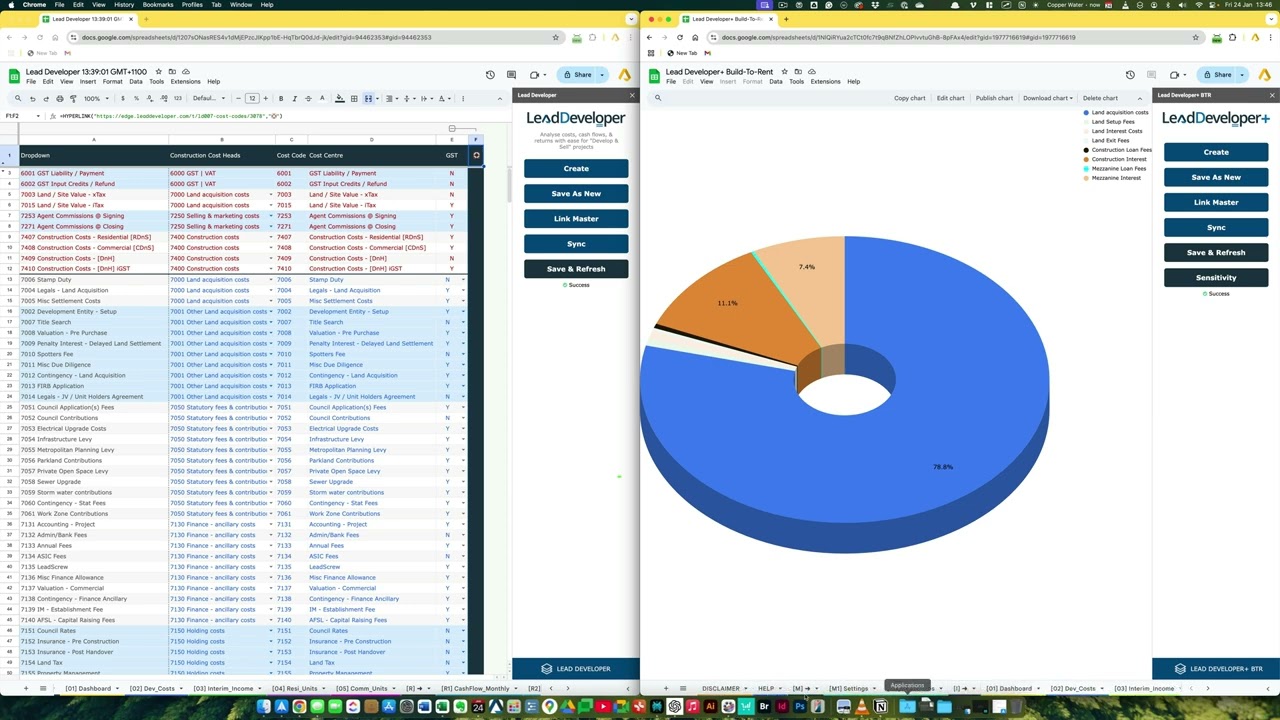

Key Differences Between Lead Developer and Lead Developer+ BTR

Key Differences Between Lead Developer and Lead Developer+ BTR

- Lead Developer is designed for straightforward feasibility applications where properties are developed and sold entirely.

- Lead Developer+ BTR focuses on build-to-rent projects, accounting for developments retained for rental purposes.

Build-to-Rent Explained

Build-to-Rent Explained

- Involves constructing properties specifically for rental after completion.

- Useful for multifamily units, apartment complexes, or townhouses retained partly for rental and partly for sale.

Operational Features in Lead Developer+

Operational Features in Lead Developer+

- Includes operational costs and net operating income from retained units.

- Offers specialized tabs for operating costs and BTR units, enabling detailed financial tracking.

Feasibility and Refinancing

Feasibility and Refinancing

- Allows flexibility for projects involving selling some units and refinancing others.

- Includes a “Permanent Loan Takeout” feature to manage loans after construction.

Reports and Design

Reports and Design

- Lead Developer+ offers additional modules for operating expenses and financial forecasting.

- Charts and reports are adjusted for build-to-rent specifics, with slight design variations.

Cash Flow Waterfall Module

Cash Flow Waterfall Module

- Future addition for advanced cash flow tracking, catering to complex rental projects.

Summary

Widespread Use: Lead Developer is popular in countries like New Zealand, Australia, and South Africa.

Widespread Use: Lead Developer is popular in countries like New Zealand, Australia, and South Africa. Financial Detail: The inclusion of operating expense modules and permanent loan tracking provides a granular view of profitability.

Financial Detail: The inclusion of operating expense modules and permanent loan tracking provides a granular view of profitability. Retained Units: Tailored for scenarios where multiple units are rented, ensuring feasibility across diverse projects.

Retained Units: Tailored for scenarios where multiple units are rented, ensuring feasibility across diverse projects.